When Calculating Return on Investment Current Assets Include

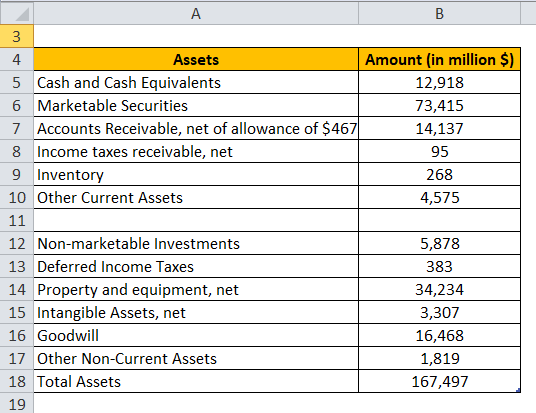

You can find your total assets on your business balance sheet. Return On Assets Definition.

Current Assets Formula Calculator Excel Template

An investment shall be accepted if the ROI exceeds a set benchmark such as cost of capital or.

:max_bytes(150000):strip_icc()/dotdash_Final_Current_Ratio_Jul_2020-03-54eeb2ed66a546ad8c2f1e5e86366170.jpg)

. In this case the net profit of the investment current value - cost would be 500 1500 - 1000 and the return on investment would be. Return on investment is equal to income made from the investment divided by the amount invested. Shareholders can evaluate the ROI of their stock holding by using this formula.

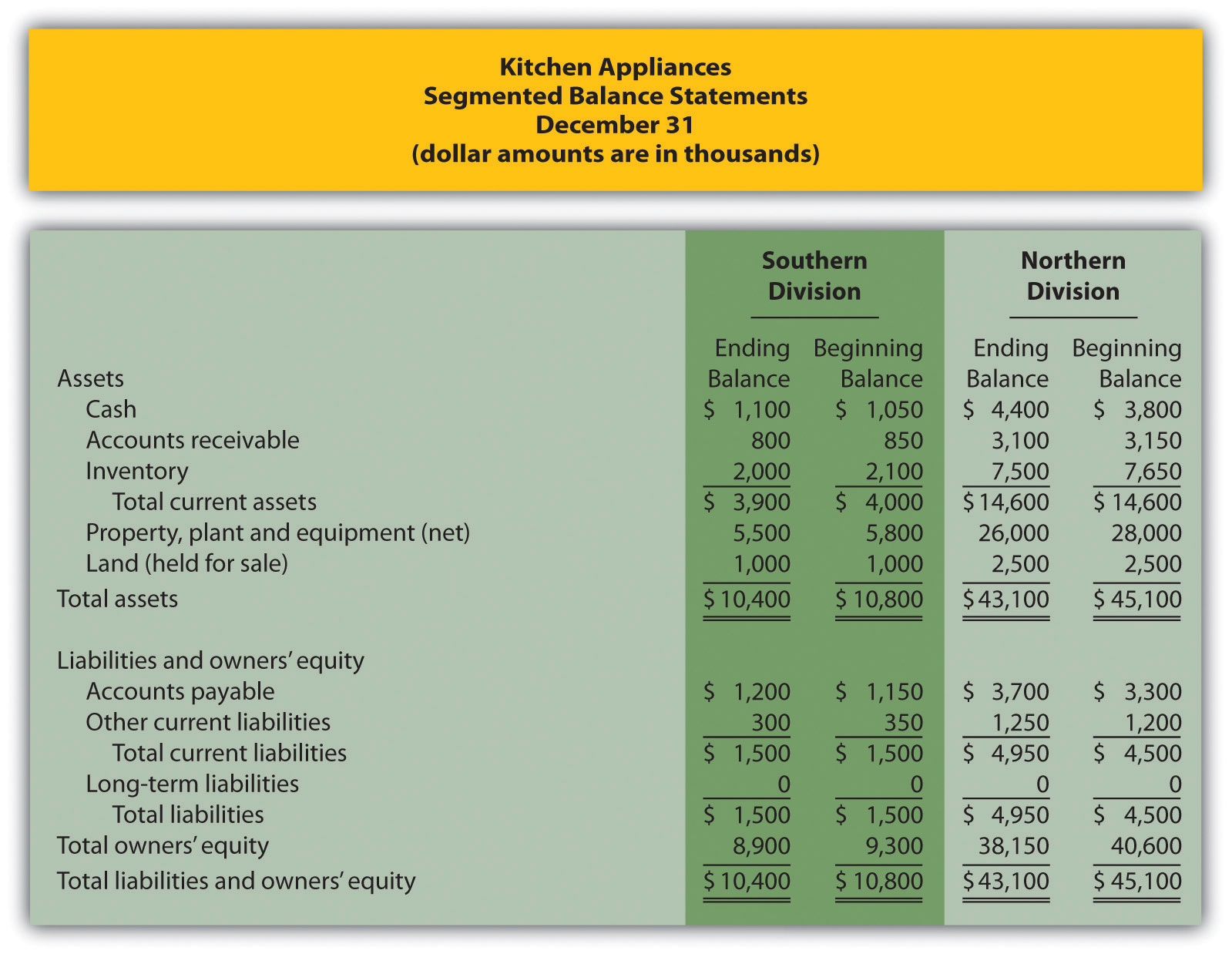

The current ratio is computed by dividing current assets by current liabilities. Using the handy ROA formula from above lets take a look at an example of computing ROA. This variation can also be very useful to shareholders and creditors.

N Number of years investment is held beginalignedtextAnnualized ROI big 1 textROI 1n -. Using ROA to determine asset-intensiveasset-light companies. There are two ways to calculate ROA.

This calculation will include current liabilities plus long-term debt. The return on investment formula. ROOA Net Income Total Assets Assets Not in Use.

Some calculations divide net income by total assets instead of equity. Using ROA to determine profitability and efficiency. Balance sheet and statement of cash flows.

The simplest way to think about the ROI formula is taking some type of benefit and dividing it by the cost. To calculate ROA use the following return on assets formula. Current Assets is calculated using the formula given below.

To calculate Home Depots total assets simply add their current assets 18529000 to their long-term assets 25474000. Return on investment is a very popular metric because of its versatility and simplicity. 100000 500000 02 or 2 percent.

The second method is simpler and we will focus on it here. A business has current assets totaling 150000 and current liabilities totaling 100000. ROAfrac text Net Income text Average Total Assets ROA Average Total AssetsNet Income.

R O A Net Income Average Total Assets. Total assets are your companys liabilities plus your equity. Annual Return Formula Calculator.

Current Assets 25460 78515 21353 164026 17635 28578 16187. The basic formula for calculating the ROI of an investment is to subtract the cost of the investment from the revenues that investment will generate and divide it by the cost of the investment to obtain a percentage. Operating income divided by average total assets.

Calculate the total amount of the firms debt. As a most basic example Bob wants to calculate the ROI on his sheep farming operation. To calculate the denominator of the ROIC equation you need access to both the firms balance sheet and statement of cash flows.

ROI Net Profit Total Investment 100. Current Assets 351754. Net profit or net income.

The Most Common Mistake People Make In Calculating ROI. Your company is ready to make a big purchase a fleet of cars a piece of manufacturing equipment a new. However it is important to note that the result of the calculation indicates the efficiency of assets to generate a return not how much shareholders are making on their investment.

ROI Investment Gain Investment Base. For example a company has a net income of 100000. ROI Net Income Current Value - Original Value Original Value 100.

What is a good ROI ratio. Return On Investment ROIGain from investment-cost of investmentcost of investment In the above formula gains from investment refers to the proceeds obtained from selling the investment of interest. The average assets are worth 500000.

The annual return is basically the geometric average of the investment return over a period of time. You can use the following formula for calculating NWC ratio. Current Assets Cash Cash Equivalents Inventory Account Receivables Marketable Securities Prepaid Expenses Other Liquid Assets.

Return on assets indicates the amount of money earned per dollar of assets. It is most helpful to use the return on assets ratio as a. Return on Investment Example 1.

From the beginning until the present he invested a total of 50000 into the project and his total profits to date sum up to 70000. Net Profit Margin x Asset Turnover Return on Assets. To calculate total assets all you have to do is add the sum of current assets and long-term assets.

Heres a couple examples. Like net working capital the current ratio assesses a businesss liquidity. An investor buys 1000 worth of stocks and sells them 1 year later when their value reaches 1500.

Gain from Investment - Cost of Investment. There are many versions of return on investment. Say your business is in.

The Return On Assets Calculator can calculate the return on assets ratio of any company if you enter in the net income and the total assets of the company. Using ROA to compare performance between companies. With these numbers youll come up with 44003000 for Home Depots total assets.

This formula is extensively used by a fund manager and portfolio analyst who analyzes the performance of a variety of assets that include stocks bonds mutual funds commodities ETFs etc. Annualized ROI 1 ROI 1 n 1 100 where. Net Working Capital Ratio Current assets Current Liabilities.

ROA Net Income Total Assets. Net working capital ratio is found by dividing current assets by current liabilities. The first version of the ROI formula net income divided by the cost of an investment is the most commonly used ratio.

Net Income Average Assets in a Period of Time Return on Assets. The basic formula for ROI is. Your business should have a minimum current ratio of 10.

The return on assets ROA ratio is a handy way to measure the profitability of a business based on a relation to their total amount of assets. Keep in mind that if you have a net loss on your investment the ROI will be negative. Calculating Invested Capital.

Profit is not the same as cash. A current ratio of less than 10 indicates low liquidity and poor financial health. You calculate the ROOA by subtracting the value of the assets not in use from the value of the total assets and then dividing the net income by the result.

The formula for ROA is. Return on Assets for Companies. The basic formula for ROI is.

In evaluating investment centers a very common ROI calculation is.

Using Return On Investment Roi To Evaluate Performance Accounting For Managers

Comments

Post a Comment